Toronto Casino Visualizations

Visualizing the Toronto Casino Public Feedback Survey

Toronto Casino Survey Results

I've been dabbling with this project for a little while now, and seeing as the on-again-off-again Special Council meeting to discuss the fate of the proposed new Toronto casino is probably on again for tomorrow, I thought it might be timely to post my results.

This project was designed to teach myself how to use the Tableau Public software, so it relies heavily on Tableau visualizations, but you can find the bit of python I used to clean the data on GitHub.

From the City's Website:

"In November 2012, City Council's Executive Committee requested the City Manager to seek the public's input on the establishment of a casino in Toronto. The City Manager engaged the firm DPRA to conduct the consultation with the public and stakeholders by the end of January 2013. Public consultation is an important part of Council's decision making process. The consultation gathered input, including the public's views and opinions on a casino generally, on possible locations for a casino, and what the public would like Council to consider when making a decision on this matter."

You can find the original data and all documentation related to the Toronto Casino Public Consultation efforts on the Toronto Open Data site.

The full consultant report on the outcome of the Toronto Casino Public Consultation is available here. After reading this report and looking at the data I felt like that there was more to the data-story to tell.

Even now, after I've done my own round of analysis and visualization, I still feel like there more to understand about how Torontonians really feel about the prospect of a new casino.

I hope this helps to illustrate some of the many differing opinions and concerns about a GTA Casino that people have expressed through the pubilc consultation process, but seriously, I'm a non-expert. Any feedback on my work is appreciated!

Responses by Location

Survey responses are geographically tied by the first three letters of the respondent postal codes, also called forward sortation area codes. Surveys have been aggregated and geocoded by sortation code. Sortation code areas do not align perfectly with ward boundaries, some span multiple wards, and in some wards there are many sortation codes, but I've provided the ward boundaries as a reference.

I wasn't surprised by the number of responses from outside of Toronto, but I do find it interesting that so many Canadians care about the fate of the Toronto casino. Surveys came in from across Canada, with sortation codes from as far west as Edmonton, Alberta and as far east as Dartmouth, Nova Scotia.

21% of the surveys didn't have a sortation code, and 6% of the sortation codes provided weren't usable. (Also, it's likely that some of the postal codes from outside of the GTA represent home addresses of people living and working in Toronto but who associate more with places out-of-town, as well as Torontoians-at-heart living abroad in other parts of Canada. Toronto has a super-nebulous and wide-reaching population.)

Torontonian Feedback by District

I also looked at the results from the different Toronto districts: North York, Etobicoke, Downtown and Scarborough. Etobicoke appears to have the highest percentatge of folks in favour of a casino.

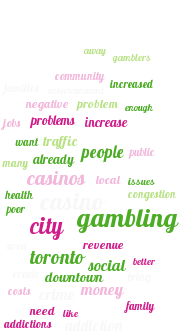

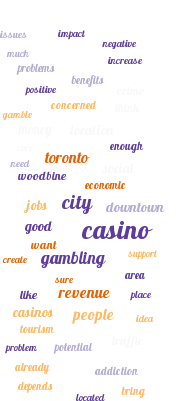

Word Clouds

Word clouds are generally considered a terrible visualization tool, but I still think they're actually a good way to begin exploring data. I've used the comments from the first question of the survey, which asks people to describe why they feel the way they do about a potential Toronto casino.

Most Common Words used in Survey Comments:

Opposed, Neutral and In Favour

I thought it was interesting that "gambling" was so large and predominant in the Opposed word cloud, but was absent in the In Favour cloud. This variation made me suspect that there were some siginficant differences in how people described and rationalized a new Toronto casino.

Word-Use Heat Map

I decided to explore these differences a bit more closely, and to look at other variables like age and gender to see if could find any other differences in word frequency.

Here are the results:

This heat map is inspired by the New York Times visualization of 2011 commencement speeches.

Money Matters?

One of the conditions being considered at Council is the minimum acceptable annual revenue that the City would require if a new casino is approved. The figure currently considered acceptable is $100 million, far exceeding the $53.7 million the OLG is offering.

The survey results suggest that, of the minority who support a casino, most are indifferent to how much the City actually makes in revenue, or would accept less than $100 million dollars in revenue a year. Only 9.26% of survey respondents indicated that the City should only accept a casino if at least $100 million dollars in revenue is guaranteed.

Location, location, (no-)location.

One of the biggest unanswered questions is Where will the new casino be built? This is something that will be ultimately determined by the OLG, but the City has been asked to recommend a preferred location.

No clear location preference emerges in the survey data. It seems like a casino is equally (un)desireable in all of the three proposed locations. Exhibition Place being the most prefered, with only 63.34% of respondents somewhat or strongly opposed.

The OLG has identified the Woodbine/Etobicoke area as being within the C2 gaming zone, separate from the rest of Toronto, and even separate from other GTA communities. Mississagua, Markham, Richmond Hill and Vaughan are included in the C1 zone with the Port Lands, Exhibition Place and Downtown Toronto.

Why did the survey question geared to the future of Woodbine only ask people if they wanted expanded gaming? Not only do the people of Etobicoke, the area surrounding Woodbine, show more interest in a new casino than residents anywhere else in the City, but expanded gaming was already approved by Council for Woodbine in 2007. And why didn't the OLG include Woodbine in the C1 zone? I couldn't find an explanation on the OLG website, and it's possible that there is a rationale behind this decision, but it seems like Woodbine was intentionally excluded as a possible location for a casino from very early on in the OLG's process, and that the opportunity to discuss a Woodbine casino as an alternative has been missed.

In any case, no-location is by far the prefered alternative, leaving Council and the OLG with a very difficult decision to make.